Degenerative joint disease, also known as osteoarthritis, degenerative arthritis, or degenerative arthropathy, is a chronic disease that affects the joints. Though it can affect any joint, it most frequently affects the hands, hips, knees, and spine.

Degenerative joint disease, or DJD, is progressive, which means symptoms worsen over time. This can make it difficult for those who suffer from DJD to participate in activities of daily living or to work. If DJD interferes with your ability to work you may be eligible for social security disability (SSD) benefits. Here is what you need to know about applying for disability benefits with degenerative joint disease.

What is degenerative joint disease?

Degenerative joint disease is the result of wear and tear on the joint. It is typically caused by repetitive motions that cause inflammation and structural damage to the joints. DJD is often accompanied by pain and stiffness, loss of function in the affected joint, decreased flexibility, swelling, and weakness. As the disease progresses, the pain and discomfort become more persistent. The inability to move without pain and discomfort can lead to weight gain and other conditions associated with it.

Degenerative joint disease can happen to anybody, but some factors increase the chances of developing the disease. These include repetitive motion, which can include lifting heavy items or even “easy” tasks like knitting; muscular dystrophy; obesity; bone disorders; infection; rheumatoid arthritis; hormone disorders, or; osteoporosis. DJD affects half of people age 65 and older and, as people age, it affects women more than men.

Can I get SSD benefits if I have degenerative joint disease?

The Social Security Administration Blue Book contains more than 100 medical conditions that may qualify people for disability benefits. There is no specific listing for degenerative joint disease, which means your symptoms must meet the symptoms of another listing. For DJD, the conditions most closely associated are the SSA’s listings for Abnormality of a major joint in any extremity or, if you’ve had joint surgery, Reconstructive surgery or surgical arthrodesis of a major weight-bearing joint.

Each of these listings has criteria you must meet to qualify for disability benefits. For abnormality of a major joint, medical records must show that you have all the following:

- Chronic joint pain or stiffness;

- Abnormal motion, instability, or immobility in the affected joint;

- An anatomical abnormality of the affected joint, and;

- Physical limitations that cause at least one of the following for at least 12 months:

- A need to use a walker, bilateral canes or crutches, or a wheelchair/scooter;

- An inability to use one arm to start, continue, or complete work-related activities and the need to use a one-handed, hand-held device, or;

- An inability to use both arms to independently start, continue, or complete work-related activities.

To qualify for SSD benefits after reconstructive surgery, you must be able to show all the following:

- Reconstructive surgery or surgical arthrodesis of a major weight-bearing joint;

- Physical limitations that have lasted, or are expected to last, at least 12 months, and;

- The need to use a walker, bilateral canes or crutches, or a wheelchair/scooter.

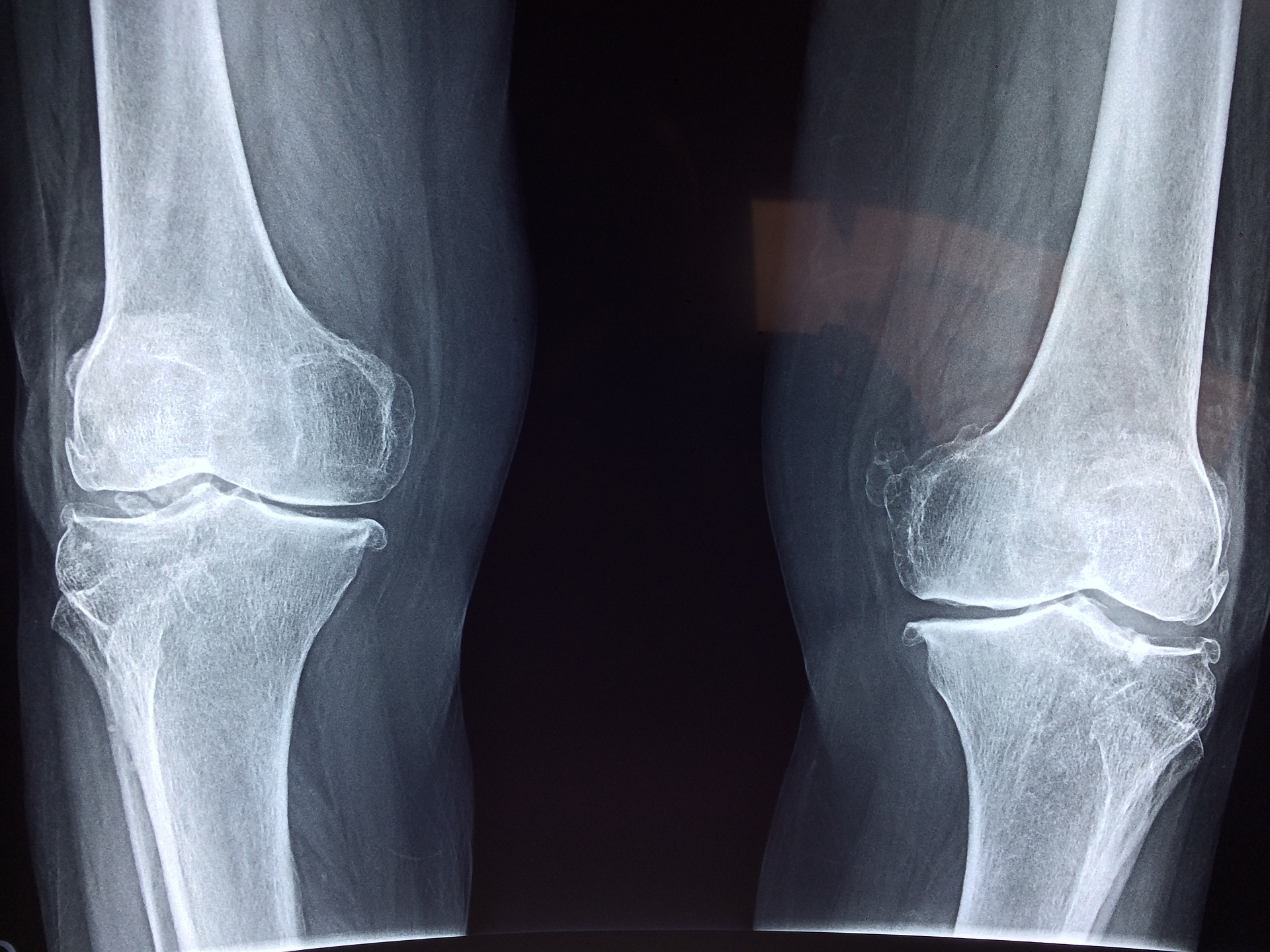

Regardless of which listing you use to apply for SSD benefits, you must have medical documentation supporting your claim. This means X-Rays, MRIs, surgical records, or other testing that shows joint abnormalities and degeneration. You will also need medical documentation that you require mobility aides to get around; the fact that you choose to use a wheelchair or scooter is insufficient.

To learn more watch our short video:

Qualifying for SSD benefits without meeting the listing

Most people who apply for disability benefits based on degenerative joint disease do not meet the Blue Book criteria; this is true for most medical conditions. But even if you don’t meet the listing criteria, it is still possible to qualify for disability benefits.

If you do not meet each of the Blue Book criteria for a specific listing – or even if you do, but the SSA nevertheless finds you ineligible benefits – you may still qualify for benefits if you can show that your DJD interferes with your ability to work. In cases where you do not meet the Blue Book listing, the SSA will have you complete a residual functional capacity assessment.

The RFC looks at what you can do despite your disability. It will assess your ability to do work-related tasks that you perform in your current job as well as any other jobs you may be able to perform based on your age, education, and experience. When completing the assessment, it is important to be as specific as possible and describe your limitations based on your worst day, to ensure the SSA gets a complete and, most importantly, accurate picture of how the DJD affects you and your ability to work.

The RFC also lets you provide information on how other medical conditions or disabilities impact your ability to work. Often, people who do not meet the medical criteria for a specific listing qualify for SSD benefits based on the totality of all their conditions. For example, if you suffer from anxiety or depression and DJD, the effects of each condition, on its own, may not qualify you for disability benefits. But taken together, the combined effects may meet or exceed a listing. For example, the pain and limitations from the DJD may worsen your anxiety and depression, making you unable to work.

Should I hire a disability attorney to help me apply for SSD?

The social security disability attorneys at The Good Law Group have more than 30 years of experience handling social security disability cases. Although you can apply for disability benefits without an attorney, our knowledge of SSA regulations and experience presenting cases means we understand what information is most likely to result in an award of benefits, and how best to present that evidence.

We offer free case consultations and, if we accept your case, you don’t pay unless you are awarded benefits. Call us at 847-577-4476 to schedule an appointment.